SUMMARY:

SUMMARY:

In the previous Q reports, Turkey’s accelerating petroleum products demand growth has been investigated. Some of the reasons behind this increase in demand were accelerating economy, increasing tourism, increasing land transportation and car preferences of the middle class. The car preferences can also be indicative of the consumer’s wealth. If the consumer starts choosing to buy big cars rather than small cars, then it can be considered that they are willing to accept the costs and has adopted an economically more optimistic expectation. Of course, all of these are subjective inferences. In this Q report an important factor in fuel demand growth, car preferences in Turkey and how they have changed, will be elaborated.

METHOD:

As one of the principal sectors in Turkey, the automotive industry is rich in data sources. For this report, the Automotive Distributors Association (ODD)’s “Pazar – Model Dökümleri” was used. Other organizations such as the Association of Automotive Parts and Components Manufacturers (TAYSAD) and the Automotive Industry Association (OSD) have also been examined.

The ODD’s end of the year excel files (usually in December) include data on the segment details of the vehicles. While the total annual figures for all years were taken, only January – November data for 2016 have been available. TSKB’s “Otomotiv Sektör Raporu” was utilised for the report’s last part.

ANALYSIS:

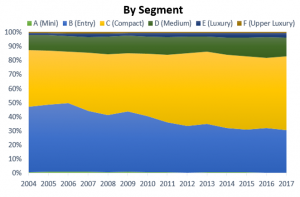

Particularly since 2006, a rapid shift can be observed from the entry-level (B) car class to compact (C) car class in Turkey. Especially in the economically stagnated years, a decrease in the B segment occurs, but it recovers rapidly afterwards.

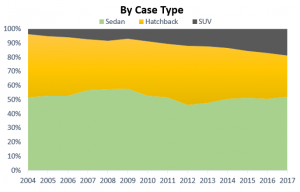

When we look at the car frame type, the share of sport utility vehicles known as SUVs can be seen increasing rapidly. While only 4% of the sales in 2004 were SUVs, this figure rose to 18% in 2017.

There is a rapid increase in the demand for large vehicles. One other reason is that the number of model-types offered for sale is correlated to the sales quantity, which can also help us explain the dynamics of the electric vehicle market.

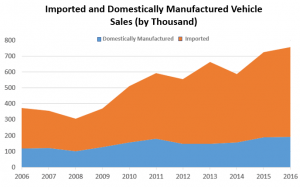

On the other hand, it can also be seen that, with the larger cars, a more favourable course regarding imported automobiles is adopted. Neither rise in exchange rate nor increase in oil prices is capable of reversing this trend.

CONCLUSION:

In Table 13 on page 72 of the TSKB report, an increase in industrial production growth is seen as the most important positive factor affecting vehicle demand, whereas Euro, tax and interest rates are the most important negative factors. Oil prices, on the other hand, affect both input raw materials (plastics etc.) and demand. A 10% increase in Brent price reduces automobile demand by 3.4%. As we tried to explain above, demand for imported and large automobiles will likely continue to increase for the time being. Actually this demand, which has been getting stronger for the last 3 years, is further increased by vehicle manufacturers’ misinformation to consumers about fuel consumption. As consumption values of cars in advertisements are falling, the actual consumption values in real life do not fall at the same speed.

If this trend persists, we can argue that we have entered a period where growing fuel demand is not an anomaly but a norm.