Monday, October 16, 2023

As part of our ‘‘WEC Mondays-Guest Speaker Series’’ we hosted Dr. Sohbet Karbuz, Director of Hydrocarbons and Energy Security at Mediterranean Observatory for Energy.

In Dr. Sohbet’s presentation on ‘‘The Role of LNG in European Gas Supply Security’’, Dr. Sohbet highlighted:

• Before Russia’s military attack on Ukraine, the EU was receiving 2/3 of its gas by pipelines from Russia, North Africa, Norway, and Azerbaijan, among which Russia has the highest share in gas supply to Europe.

• EU’s domestic gas supply had already peaked back in 1970s when domestic supply dominated the European gas market. However, less than 10% of European gas demand was met by domestic supply in 2022 due to more competitive imported gas and ever-increasing demand for gas in Europe.

• EU’s dependence on imported gas will increase even further since the largest gas field in Europe-Groningen was shut down permanently earlier this month.

• As the Ukrainian transit contract will expire on 31 Dec 2024 and unlikely to be renewed, EU will need more LNG from the rest of the world including Russia to meet its energy demand.

• REPowerEU plan was initiated in March 2022 to end EU’s dependency on Russian fossil fuel imports. Specifically, REPowerEU aims to increase the imports from non-Russian suppliers 50bcm of LNG, and 10bcm of pipeline gas.

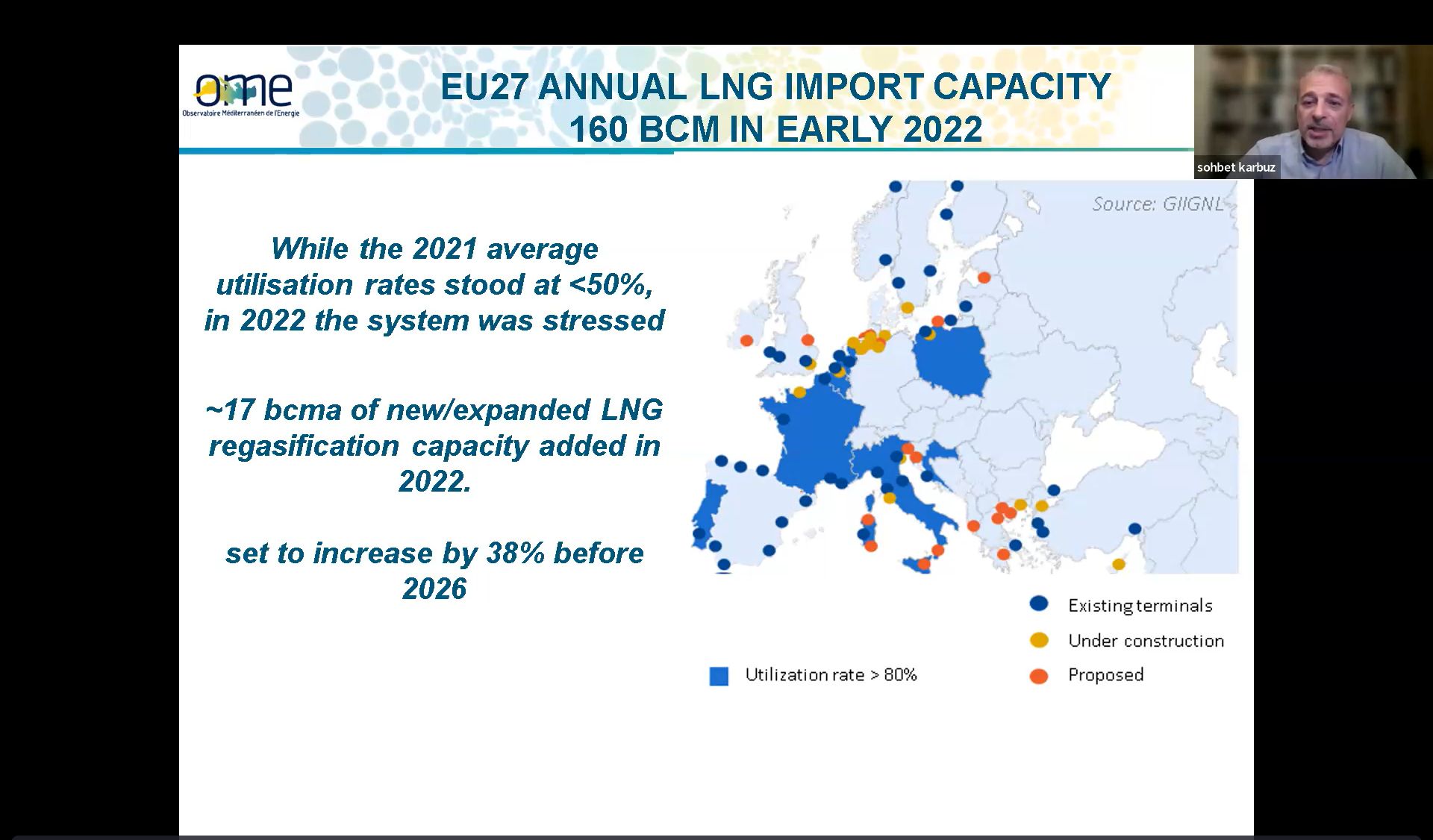

• In order to utilize the additional LNG, 17bcm LNG regasification capacity was added in 2022 alone. EU’s current regasification capacity stands at 157bcm which is estimated to increase by 38% by 2026.

• Although, EU’s regasification capacity increase was remarkable, the EU suffers from distribution problems, nonetheless. Spain has the highest regasification capacity in Europe, but to bring gas to where it’s most needed-Eastern Europe is a huge challenge EU faces.

• REPowerEU targeted more renewables and low carbon energy sources to substitute Russian energy supply. Moreover, REPowerEU extended 15% gas demand reduction target to 2024 by heavily emphasizing energy efficiency and energy saving consumption behavior.

• Last but not least, REPowerEU set up a new storage regulation which required EU to fill 80% of total storage capacity by 01 November 2022 and 90% of total storage capacity by 01 November each year thereafter. EU has successfully achieved the gas storage target so far, primarily due to low demand in China.

• However, EU can not rely on low demand in China for too long. Once, China’s gas demand is back on track, there won’t be as abundant LNG supply left in the market as it’s been for the last two years.

• The EU will need to search for alternative sources of energy and suppliers. Set pragmatic targets regarding its energy demand and climate goals in order to achieve secure and affordable energy.