Renewables 2023

Analysis and forecasts to 2028

Key Findings:

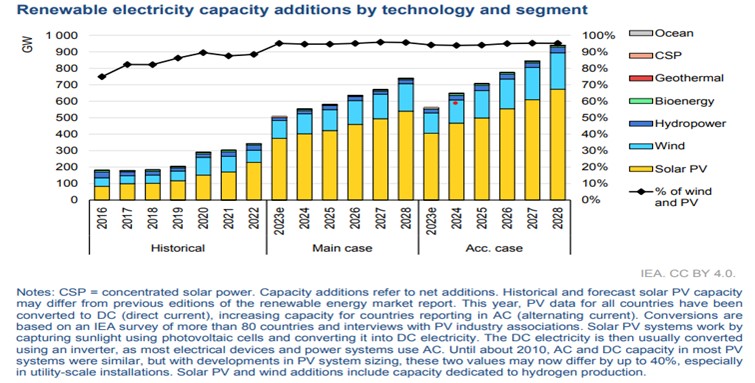

- Global annual renewable capacity additions increased by almost 50% to nearly 510 gigawatts (GW) in 2023, the fastest growth rate in the past two decades.

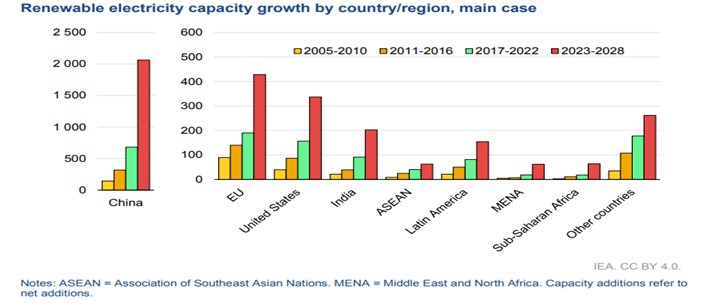

This is the 22nd year in a row that renewable capacity additions set a new record. While the increases in renewable capacity in Europe, the United States and Brazil hit all-time highs, China’s acceleration was extraordinary. In 2023, China commissioned as much solar PV as the entire world did in 2022, while its wind additions also grew by 66% year-on-year. Globally, solar PV alone accounted for three-quarters of renewable capacity additions worldwide.

- Achieving the COP28 target of tripling global renewable capacity by 2030 hinges on policy implementation or lack thereof.

These 4 main challenges must be addressed on the policy level in order to achieve the COP28 target and they are: 1) policy uncertainties and delayed policy responses to the new macroeconomic environment; 2) insufficient investment in grid infrastructure preventing faster expansion of renewables; 3) cumbersome administrative barriers and permitting procedures and social acceptance issues; 4) insufficient financing in emerging and developing economies.

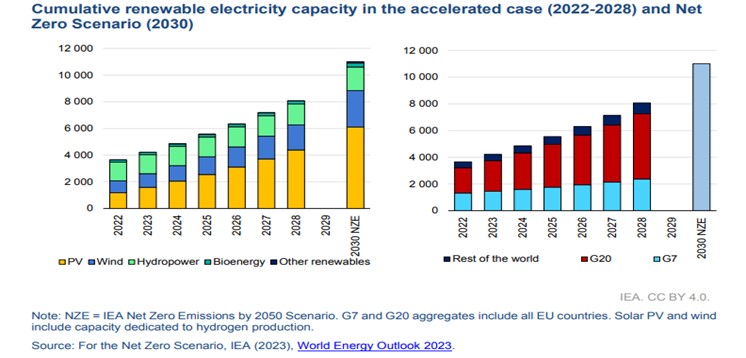

- G20 countries account for almost 90% of global renewable power capacity today.

In the accelerated case, which assumes enhanced implementation of existing policies and targets, the G20 could triple their collective installed capacity by 2030. As such, they have the potential to contribute significantly to tripling renewables globally. However, to achieve the global goal, the rate of new installations needs to accelerate in other countries, too, including many emerging and developing economies outside the G20, some of which do not have renewable targets and/or supportive policies today.

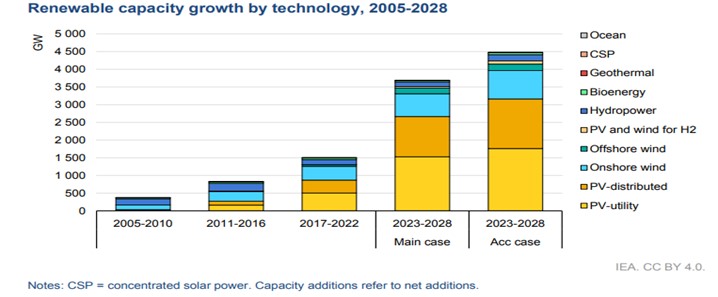

- The global power mix will be transformed by 2028.

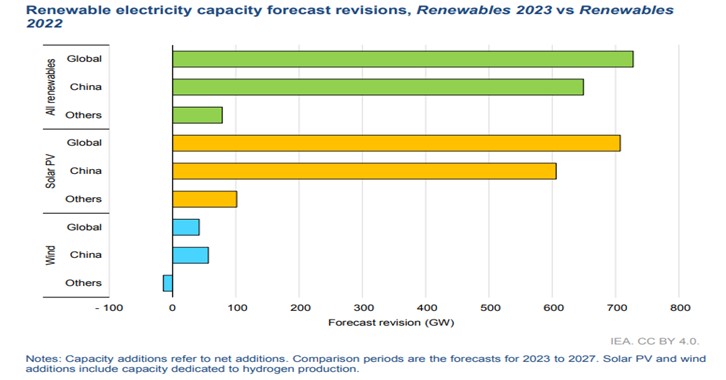

The world is on course to add more renewable capacity in the next five years than has been installed since the first commercial renewable energy power plant was built more than 100 years ago. In the main case forecast in this report, almost 3 700 GW of new renewable capacity comes online over the 2023-2028 period, driven by supportive policies in more than 130 countries. Solar PV and wind will account for 95% of global renewable expansion, benefiting from lower generation costs than both fossil and non-fossil fuel alternatives.

- Over the coming five years, several renewable energy milestones are expected to be achieved:

- In 2024, wind and solar PV together generate more electricity than hydropower.

- In 2025, renewables surpass coal to become the largest source of electricity generation.

- Wind and solar PV each surpass nuclear electricity generation in 2025 and 2026 respectively.

- In 2028, renewable energy sources account for over 42% of global electricity generation, with the share of wind and solar PV doubling to 25%.

- China is the world’s renewables powerhouse.

China accounts for almost 60% of new renewable capacity expected to become operational globally by 2028. Despite the phasing out of national subsidies in 2020 and 2021, deployment of onshore wind and solar PV in China is accelerating, driven by the technologies’ economic attractiveness as well as supportive policy environments providing long-term contracts. Our forecast shows that China is expected to reach its national 2030 target for wind and solar PV installations this year, six years ahead of schedule.

China’s role is critical in reaching the global goal of tripling renewables because the country is expected to install more than half of the new capacity required globally by 2030. At the end of the forecast period, almost half of China’s electricity generation will come from renewable energy sources.

- The US, the EU, India and Brazil remain bright spots for onshore wind and solar PV growth.

Solar PV and onshore wind additions through 2028 is expected to more than double in the United States, the European Union, India and Brazil compared with the last five years. Supportive policy environments and the improving economic attractiveness of solar PV and onshore wind are the primary drivers behind this acceleration. In the European Union and Brazil, growth in rooftop solar PV is expected to outpace large-scale plants as residential and commercial consumers seek to reduce their electricity bills amid higher prices.

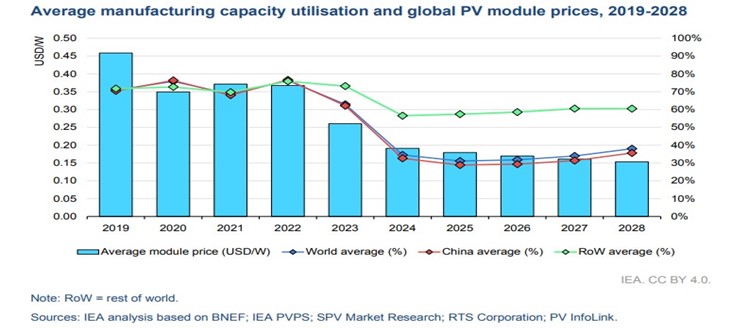

- Solar PV prices plummet amid growing supply gluts.

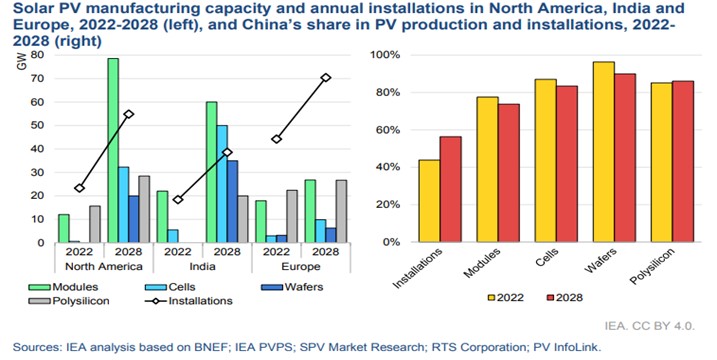

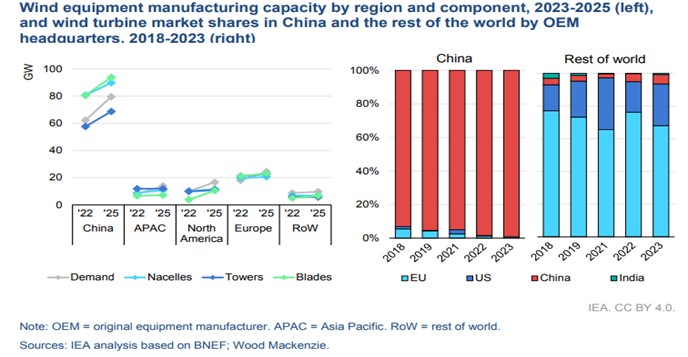

In 2023, spot prices for solar PV modules declined by almost 50% year-on-year, with manufacturing capacity reaching three times 2021 levels. The current manufacturing capacity under construction indicates that the global supply of solar PV will reach 1 100 GW at the end of 2024, with potential output expected to be three times the current forecast for demand. Despite unprecedented PV manufacturing expansion in the United States and India driven by policy support, China is expected to maintain its 80-95% share of global supply chains (depending on the manufacturing segment).

- Onshore wind and solar PV are cheaper than both new and existing fossil fuel plants.

In 2023, an estimated 96% of newly installed, utility-scale solar PV and onshore wind capacity had lower generation costs than new coal and natural gas plants. In addition, three-quarters of new wind and solar PV plants offered cheaper power than existing fossil fuel facilities. Wind and solar PV systems will become more cost-competitive during the forecast period.

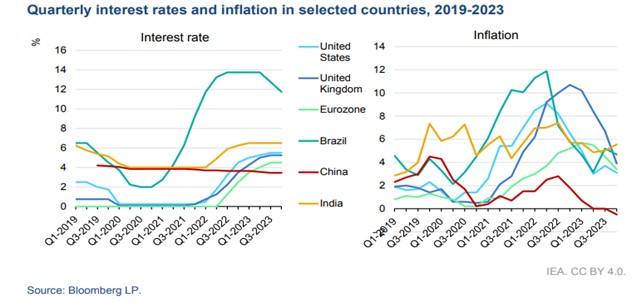

- The new macroeconomic environment presents further challenges that policy makers need to address.

In 2023, new renewable energy capacity financed in advanced economies was exposed to higher base interest rates than in China and the global average for the first time. Since 2022, central bank base interest rates have increased from below 1% to almost 5%. In emerging and developing economies, renewables developers have been exposed to higher interest rates since 2021, resulting in higher costs hampering faster expansion of renewables.

- The renewable energy industry, particularly wind, is grappling with macroeconomic challenges affecting its financial health – despite a history of financial resilience.

The wind industry has experienced a significant decline in market value as European and North American wind turbine manufacturers have seen negative net margins for seven consecutive quarters due to volatile demand, limited raw material access, economic challenges, and rising interest rates.

- The forecast for wind capacity additions is less optimistic outside China, especially for offshore.

Offshore wind has been hit hardest by the new macroeconomic environment, with its expansion through 2028 revised down by 15% outside China. The challenges facing the industry particularly affect offshore wind, with investment costs today more than 20% higher than only a few years ago. In 2023, developers have cancelled or postponed 15 GW of offshore wind projects in the United States and the United Kingdom. For some developers, pricing for previously awarded capacity does not reflect the increased costs facing project development today, which reduces project bankability.

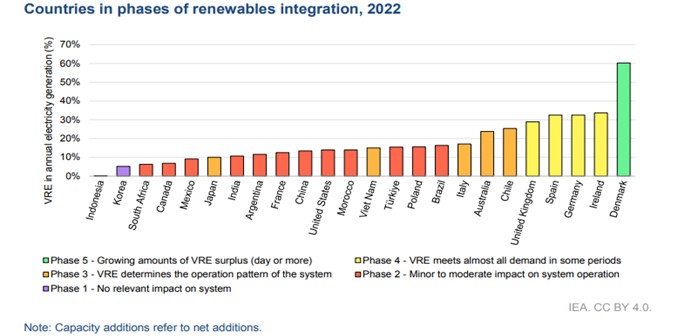

- Faster deployment of variable renewables increases integration and infrastructure challenges.

The share of solar PV and wind in global electricity generation is forecast to double to 25% in 2028 in our main case. This rapid expansion in the next five years will have implications for power systems worldwide. In the European Union, annual variable renewables penetration in 2028 is expected to reach more than 50% in seven countries, with Denmark having around 90% of wind and solar PV in its electricity system by that time. Although EU interconnections help integrate solar PV and wind generation, grid bottlenecks will pose significant challenges and lead to increased curtailment in many countries as grid expansion cannot keep pace with accelerated installation of variable renewables.

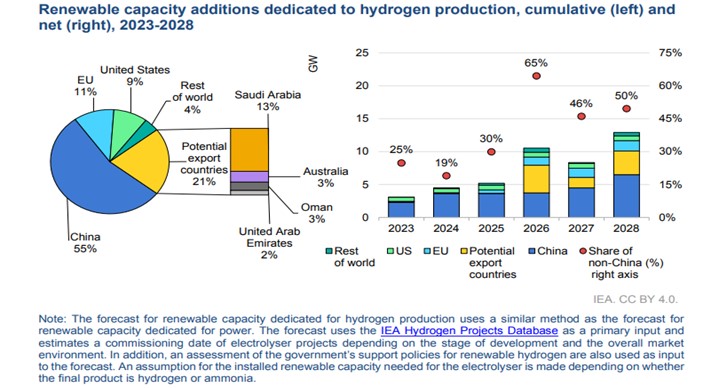

- Current hydrogen plans and implementation don’t match.

Renewable power capacity dedicated to hydrogen-based fuel production is forecast to grow by 45 GW between 2023 and 2028, representing only an estimated 7% of announced project capacity for the period. China, Saudi Arabia and the United States account for more than 75% of renewable capacity for hydrogen production by 2028. Despite announcements of new projects and pipelines, the progress in planned projects has been slow.

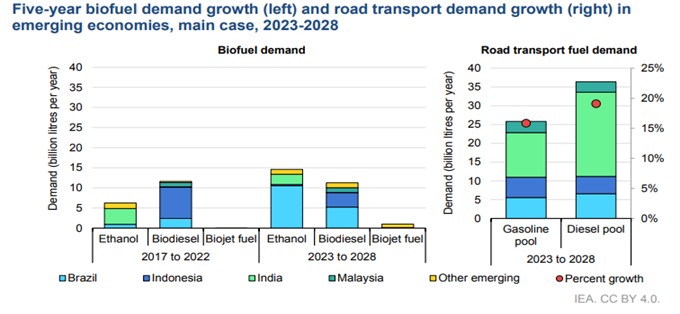

- Biofuel deployment is accelerating and diversifying more into renewable diesel and biojet.

Fuel Emerging economies, led by Brazil, dominate global biofuel expansion, which is set to grow 30% faster than over the last five years. Supported by robust biofuel policies, increasing transport fuel demand and abundant feedstock potential, emerging economies are forecast to drive 70% of global biofuel demand growth over the forecast period.

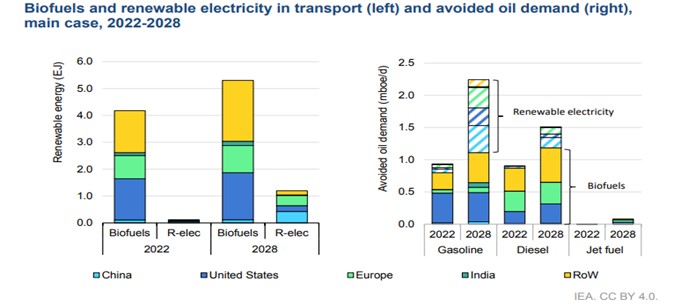

- Electric vehicles (EVs) and biofuels are proving to be a powerful complementary combination for reducing oil demand.

Globally, biofuels and renewable electricity used in EVs are forecast to offset 4 million barrels of oil-equivalent per day by 2028, which is more than 7% of forecast oil demand for transport. Biofuels remain the dominant pathway for avoiding oil demand in the diesel and jet fuel segments. EVs outpace biofuels in the gasoline segment, especially in the United States, Europe and China.

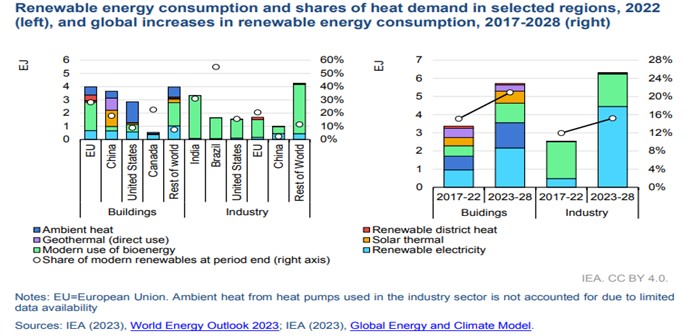

- Renewable heat accelerates amid high energy prices and policy momentum – but not enough to curb emissions.

Modern renewable heat consumption expands by 40% globally during the outlook period, rising from 13% to 17% of total heat consumption. These developments come predominantly from the growing reliance on electricity for process heat – notably with the adoption of heat pumps in non-energy-intensive industries – and the deployment of electric heat pumps and boilers in buildings, increasingly powered by renewable electricity.

China, the European Union and the United States lead these trends, owing to supportive policy environments; updated targets in the European Union and China; strong financial incentives in many markets; the adoption of renewable heat obligations; and fossil fuel bans in the buildings sector.

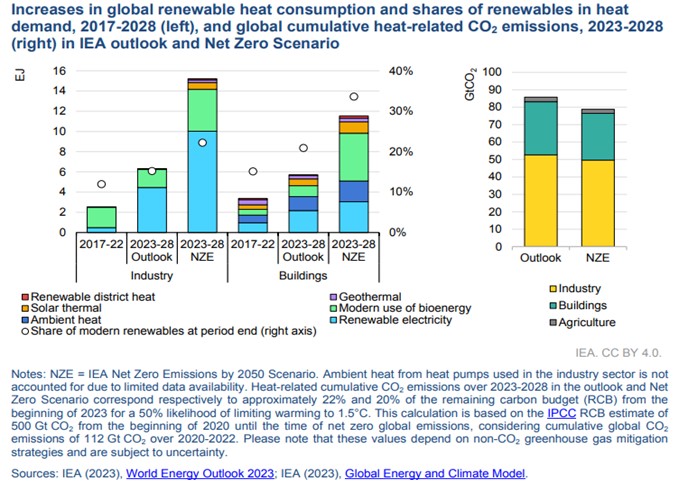

- However, the trends to 2028 are still largely insufficient to tackle the use of fossil fuels for heat and put the world on track to meet Paris Agreement goals.

Without stronger policy action, the global heat sector alone between 2023 and 2028 could consume more than one-fifth of the remaining carbon budget for a pathway aligned with limiting global warming to 1.5°C. Global renewable heat consumption would have to rise 2.2 times as quickly and be combined with widescale demand-side measures and much larger energy and material efficiency improvements to align with the NZE Scenario.

Full Report: Renewables 2023 – Analysis – IEA