SUMMARY:

SUMMARY:

An interesting case emerged while examining the effect of the 10% discount on natural gas prices, which was introduced on 1st October 2016, on industrial natural gas prices. Whilst discussing the impact of the drop in input cost, it was discovered that other industries, dependent on energy intensive products, were unaffected by the discount. Digging a little deeper into details, a common misconception emerged that most of the export sector make their sales in Euro in the domestic market as well. However, the main culprit for the industry was high energy prices. In this Q report, we will examine how the energy prices behave relative to the prices of goods sold by industries.

METHOD:

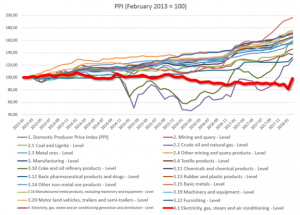

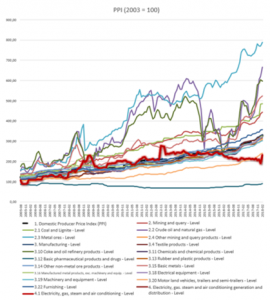

Turkish Statistical Institute (TÜİK) data was obtained from the Central Bank’s EVDS system and August 2005, January 2013 and February 2013 were normalised to 100. All energy intensive sectors were compared with the data on “Electricity, Gas, Steam and Air Conditioning”, coded under 4.1. It was then re-examined with the final sale prices, with VAT being added, derived from the DOSİDER data bank. The calculations of January 2013 gave an interesting result with the highest electricity prices to that date. Another calculation was therefore made for February 2013.

ANALYSIS:

The Producer Prices of electricity and gas-intensive, which were at 100 in 2003, experienced the smallest growth in the production prices among all energy-intensive industries. (Thick red line in the graph below)

Given the atypical increase in prices in January 2013, the electricity-gas prices can be shown to be much lower, if January 2013 is taken as 100. If we accept February 2013 as 100, the Producer Price Index (PPI) at an electricity-gas level drops to 98 in real terms. If we take January 2013 as 100, this number drops to 84. This concludes electricity-gas prices saw a real decrease in price despite the increase in inflation, and has seen the cheapest wholesale industry prices compared to other industry prices.

CONCLUSION:

The electricity and gas prices in Turkey remained below the price trends in all other industries. While the industrial sector constantly updating the price of their products, electricity and natural gas couldn’t match their pace. This can also be clearly observed from the PPI figures. In all energy intensive sectors, even crude oil users, for example, price reductions are not transmitted to product prices. When selling goods with Euros, the reasons behind the complaints of high prices when the electricity-gas inputs with the Turkish Lira has no discernible increase in real terms should be investigated. Why would an energy-intensive sector’s industrialist who updates its prices complain about the “high electricity-gas input prices” which have fallen in real terms? Statistics would be useful to answer this question.