SUMMARY

Key findings in the report are as follows:

- The Energy Transition is off-track. Covid-19 and the ripple effects of the Ukraine crisis have further compounded the challenges facing the transition.

- Limiting global warming to 1.5°C requires cutting carbon dioxide (CO2) emissions by 37 gigatons from 2022 levels and achieving Net-Zero emissions in the energy sector by 2050. 1.5 °C Pathway requires a wholescale transformation of the way societies consume and produce energy.

- Annual deployment of at least 1000 GW of renewable power is needed to stay on 1.5 °C In 2022, around 300 GW of renewable power were added globally, accounting for 83% of new capacity compared to a 17% share combined for fossil fuel and nuclear additions.

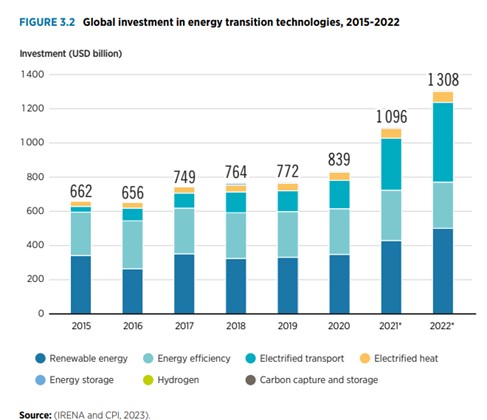

- Policies and Investments are not consistently moving in the right direction. In 2022, we saw the highest level of fossil fuel subsidies ever. While global investment across all energy transition technologies reached a record high of USD 1.3 trillion in 2022, Fossil fuel capital investments were almost twice those of renewable energy investment.

- The share of renewable energy in the global energy mix would need to increase from 16% in 2020 to 77% by 2050. 12 – fold increase in renewable electricity capacity by 2050.

- Electricity would become the main energy carrier, accounting for over 50% of total final energy consumption by 2050. Renewable energy deployment, improvements in energy efficiency, electrification of end-use sectors would contribute to this shift. In addition, modern biomass and hydrogen would both play more significant roles meeting 16% and 14% of total final energy consumption by 2050, respectively.

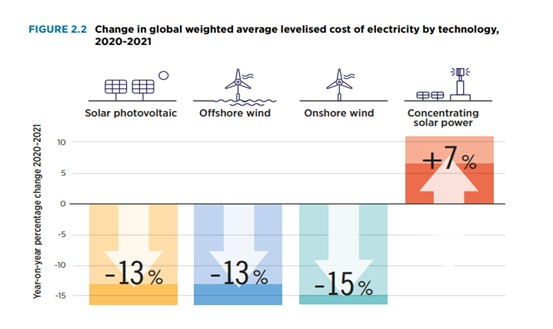

- Despite renewable electricity costs continuing their historic downward trend, an enduring investment gap still exists. A cumulative USD 150 trillion is required to realize the 1.5 °C target by 2050, averaging over USD 5 trillion in annual terms which is almost four times the record high investment made in 2022. In 2021, 163Gw of renewable power generation produced electricity that cost less than the electricity generated from the cheapest source of new fossil fuel-based capacity. These 163GW accounted for 73% of the total new renewable power generation capacity added globally.

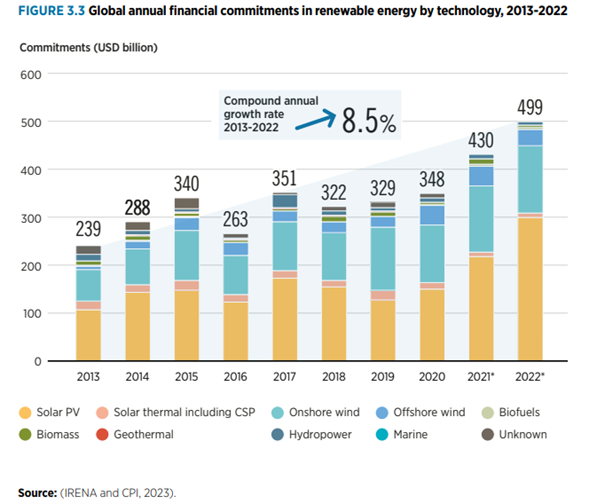

- Renewable energy investment remains concentrated in a limited number of countries and focused on only a few technologies. Africa accounted for only 1% of additional capacity in 2022. While many transition technology choices are available, most investments were in Solar PV and wind power (95% of total investment). Greater volumes of funding need to flow towards other energy transition technologies such as: biofuels, hydropower, and geothermal energy.

- The Global weighted average Levelized Cost of Electricity (LCOE) of newly commissioned utility-scale Solar PV projects fell by 88% between 2010 and 2021. LCOE of CSP (concentrated solar power) fell by 68%, and onshore, offshore wind by 68% and 60% respectively.

Source: IRENA-World Energy Transition Outlook 2023.

- As an energy transition fuel, hydrogen and its derivatives (ammonia and methanol) will play a unique role in the energy transition, especially for industrial processes and certain transport modes. However, green hydrogen is still at its infancy. Policy support and investments are needed to scale it to a mainstream energy source. By 2050, 94% of hydrogen would be renewable based in the 1.5 °C Hydrogen would play a key role in the decarbonization of end-users and flexibility of the power system.

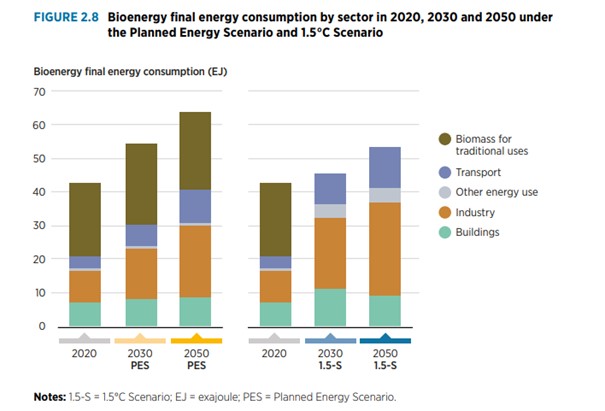

- Bioenergy plays a key role in the energy transition, under IRENA’s 1.5 °C scenario, bioenergy’s share in the primary energy supply would grow to 22% in 2050. By the same year, the share of modern uses of bioenergy in TFEC would grow to 15% globally. The industry sector would account for the majority of this consumption (52%), followed by transport (23%), buildings (18%), and other categories.

Source: IRENA–World Energy Transition Outlook 2023

- Hard-to-decarbonize industry sectors require a range of solutions such as: options based on green hydrogen, bioenergy, direct electrification, and integration of CCS and BECCS to tackle residual emissions, as well as energy efficiency and circular economy principles. Scale-up of these solutions require policy tools which include industrial decarbonization roadmaps, green public procurement, support for R&D, international collaboration in technology transfer and investment.

- With only 0.04 Gt of carbon captured in 2020. From Carbon Capture and Storage to Bioenergy with Carbon Capture and Storage (BECCS), and other methods should be scaled up to 7Gt by 2050.

- In the buildings sector, efficiency is the main enabler of the energy transition. Efficient appliances are to be increasingly adopted and cooking would need to rapidly adopt electricity-powered efficient stoves and sustainable biomass. Some widely adopted policies in this sector include building codes, bans on the use of fossil fuels for heating, financial and fiscal incentives for renovation, efficiency, and renewables. Targets for net-zero buildings, minimum energy performance standards for appliances and mandates for solar hot water for public buildings.

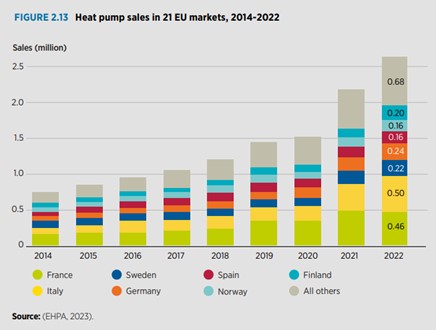

- Heat pumps will play a crucial role in decarbonizing space and water heating and making space coding more efficient.

Source: IRENA–World Energy Transition Outlook 2023

- In total, renewables share would grow to 84% of the final consumption in road transport sector by 2050. Policies for road transport would need to support the scale-up of electric vehicles and charging infrastructure. Policy tools in this regard could also include the phasing out of internal combustion engine vehicles, targets around zero-emission vehicles, zero-emission zones, and preferential measures at the city level.

Full Report: “World Energy Transition Outlook 2023 1.5 °C Pathway”, International Renewable Energy Agency