Key findings in the report are as follows:

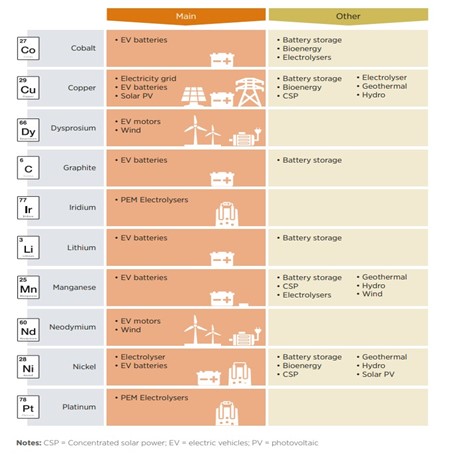

- ‘‘Critical Materials’’ refers to minerals and metals generally viewed as highly important as inputs for a renewables-based energy transition, including but not limited to Cobalt, Copper, Graphite, Iridium, Lithium, Manganese, Nickel, Platinum, and selected rare earth elements.

- Selected Critical Materials Energy Related Technology Applications

- The Energy Transition will be a main driver of demand for several critical materials. IREA’s 1.5 °C scenario includes 33,000 GW of Renewable power and electrification of 90% of Road transport in 2050.

- Assessment of the criticality of materials is dynamic and continuously changing owing to Economic, Geopolitical, and Technological factors. Presently, there is no universally accepted definition of critical materials.

- Critical Material supply disruptions have minimal impact on Energy Security, but outsized impacts on the Energy Transition. For, already built renewable infrastructure could operate for decades. On the other hand, New renewable infrastructures could not be built if there is a supply disruption in critical materials which ultimately undermines the energy transition.

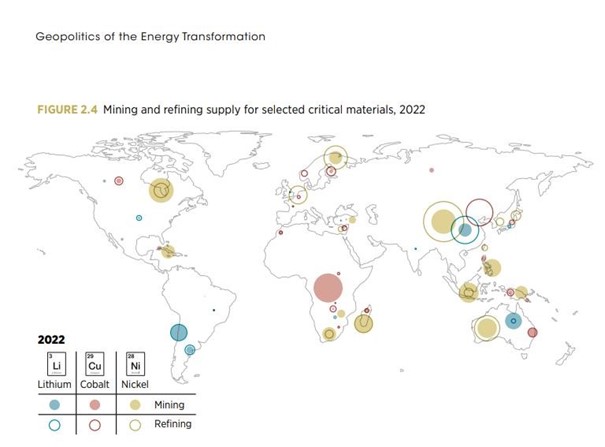

- Dependency risks and supply dynamics of critical materials fundamentally differ from those of fossil fuels. Despite there is no scarcity of reserves for Energy Transition materials, capabilities for mining and refining them are very limited now due to under-investment in upstream activities.

- The Mining and processing landscape of critical materials is geographically concentrated, with a select group of countries playing dominant role. For instance, 100% of natural graphite, dysprosium supply comes from China. 70% of Cobalt comes from Congo, 47% of Lithium comes from Australia.

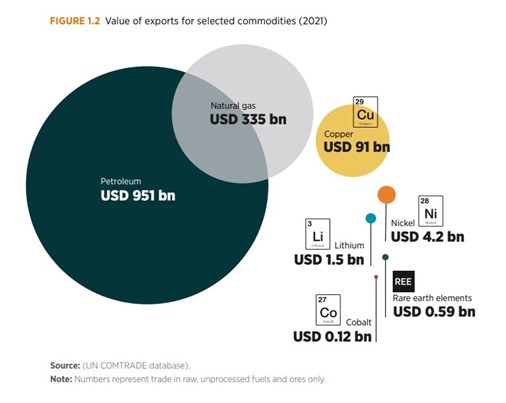

- 15 billion tons of fossil fuels were extracted in 2021 alone. Oil and Gas exports represented a value of USD 2 trillion in 2021. On the other hand, only 10 million tons of critical materials were produced for low-carbon technologies in 2022.

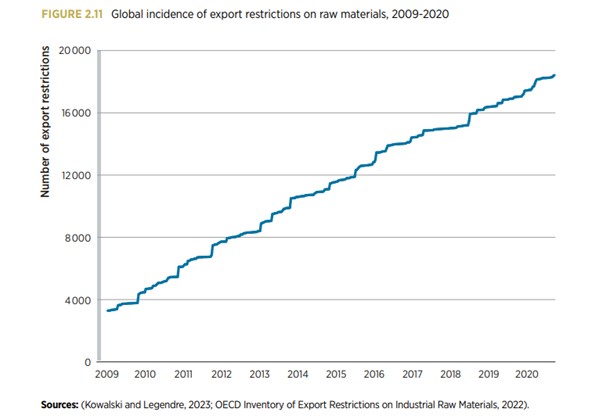

- Export restrictions on raw materials are a growing concern in international trade. Incidences of such restrictions have grown more than fivefold over the past decade (Figure 2.11) (OECD, 2023). Export restrictions usually take multiple forms, including export quotas, export taxes, obligatory minimum export prices, or licensing

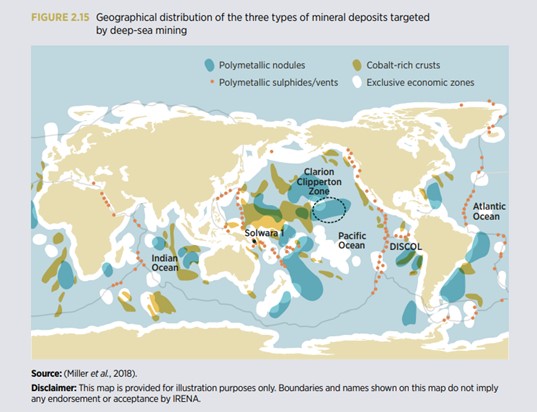

- A growing number of countries and corporations are showing interest in deep-sea mining for critical materials, that is, extracting mineral resources from the ocean floor. To date, 22 state and private contractors hold 31 mining exploration contracts to search for polymetallic nodules, polymetallic sulphides and cobalt-rich ferromanganese crusts which are extremely rich in valuable metals with high-grade ore, such as cobalt, copper and manganese.

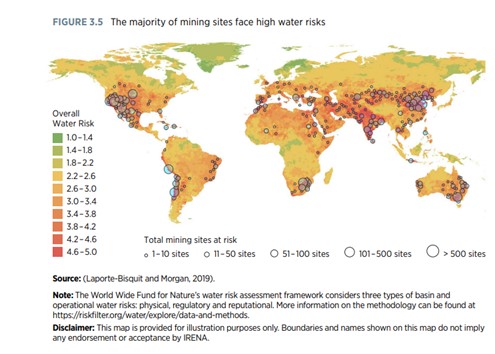

- Critical material mining projects can exacerbate water stress. About half of the global copper and lithium production, for example, is concentrated in high-water-stress areas (Gielen et al., 2022b; IRENA, forthcoming). This includes the “lithium triangle”, a lithium-rich (65% of the world’s lithium reserves) region in Andes encompassed by the borders of Argentina, Bolivia and Chile.

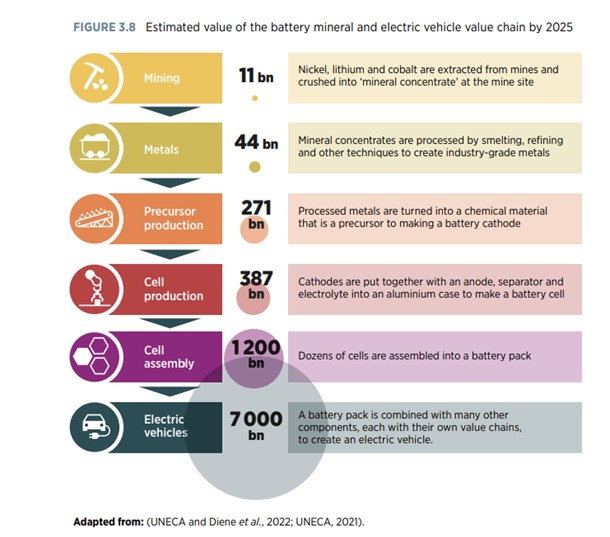

- Many battery minerals are mined in developing countries in Africa, Asia and Latin America, the actual value-addition work, such as smelting, refining, cell assembly and ultimately EV production often takes place elsewhere. As Figure 3.8 illustrates, the mining of nickel, lithium and cobalt has only a 0.6% share in the total EV value chain (1.1% if metal smelting and refining are included).

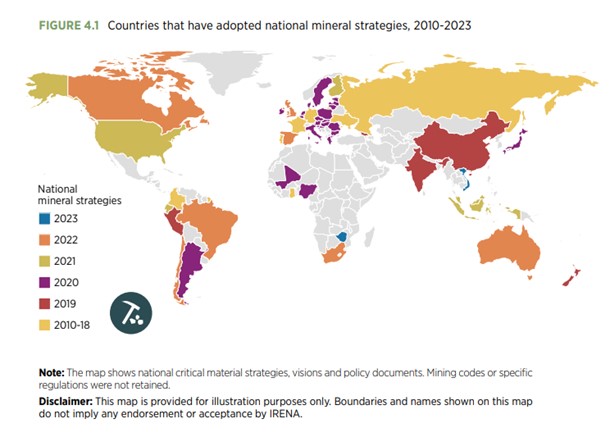

- The concentration of critical material mining and processing in a handful of countries has raised concerns about the reliability of global supply chains, prompting governments and stakeholders to develop strategies to mitigate their vulnerability. These strategies aim to secure access to critical minerals and materials, promote domestic production, and reduce dependence on any single supplier or region.

Policy Considerations and The Way Forward

- Comprehensive, economy-wide evaluations of critical material demand are essential to identify potential risks and help avoid competition between sectors. Countries should carefully assess the effects of surging demand for critical materials across all economic sectors, in line with their net-zero strategies. Currently, most demand for these materials comes from sectors unrelated to the energy transition, including electronics, aviation, defense, healthcare, and steel and aluminum production.

- No country alone can fulfil its demand for all critical materials, so collaborative strategies that benefit all involved need to be developed and implemented. Given the extensive lead times for establishing new mines and processing plants, concentrated supply chains are expected to persist in the near future. Countries should aim to develop dual strategies to ensure co-operation to keep markets functioning while also working to diversify supply chains in the long term.

- Comprehensive assessments of critical materials should be conducted for each mineral to fully grasp the dependencies, risks and innovations that may affect supply and demand. Despite the long list of identified critical materials, not all are equally important for the energy transition, nor are their criticality assessments consistent. For instance, innovation has resulted in an increased use of substitute materials for those considered critical, such as neodymium, copper, and lithium.

- Geopolitical risks can be mitigated through enhanced investment in research and development, which would expedite the creation of alternative solutions, boost efficiency, and expand recycling and repurposing options. Several strategies can be employed to prevent major supply challenges leading up to 2050, with a focus on this decade. Key among these are product design strategies to minimize the use of critical materials, and the recycling and reuse of products to reclaim scarce materials.

- Greater data transparency and oversight of certain critical materials are required to mitigate uncertainty in supply and demand projections. The starting point should be the collection of more detailed information and data on reserves, production, investment, and pricing, among other factors, to track current supply and increase market transparency. The adoption of international quality standards and certification for key products involving critical materials could also facilitate market formation.

- International co-operation is crucial in creating transparent markets with coherent standards and norms, grounded in human rights, environmental stewardship and community engagement. The energy-driven mineral boom offers a chance to rewrite the legacy of the extractive industry. Known issues surrounding mining practices need a proactive response from both nations and corporations. Importer and exporter countries must collaborate to develop supply chains that uphold clear standards regarding human rights, environmental concerns and community engagement. These standards are essential to human security and their absence is one of the root causes of geopolitical instability. In this regard, mining corporations should be held accountable for the responsible management of extraction processes.

Full Report: “Geopolitics Of The Energy Transition-Critical Materials”, International Renewable Energy Agency