SUMMARY:

SUMMARY:

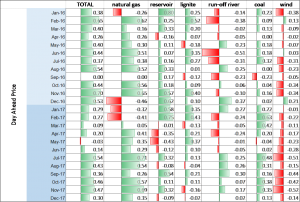

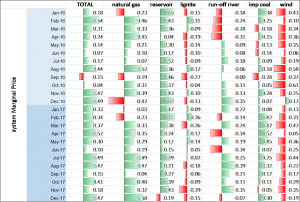

Electricity prices are theoretically determined according to marginal production costs in the market. Many models rather prefer to determine by analyzing marginal production power plants and their prices. Marginal production power plants are generally known as natural gas and imported coal plants, however; it is useful to analyze the price relation and production technologies by resource type on a monthly basis. It is important to understand not just price enhancing effects but also price reducing effects of these relationships, together with their development over time. In this Q report, it is argued that MCP (market clearing price) and SMP (system marginal price) of total power generation, natural gas, reservoir and run-off river hydroelectric, lignite, coal and wind power plants on a monthly basis.

METHOD:

Day ahead market price and system marginal price were added to actual production data obtained from EXIST (Istanbul Energy Exchange) transparency platform and converted to CSV format. On Microsoft Azure platform, production and price data are coded with periodic filtering to find their relationship. If the result is 1, then there is a positive correlation, if it is -1, there is a negative correlation, for the values in between correlation varies accordingly. For example, if the relation is 0.8, price and production are in the same direction (production increases with price), if negative, they are in opposite direction (production decreases with price). Only the years 2016 and 2017 are examined monthly.

ANALYSIS:

If we consider MCP (market clearing price) and day ahead prices, the most powerful price relation is observed between reservoir hydroelectric power plants and prices in January and February. This relation was much more powerful in 2016. Reservoir hydroelectric power plants have the most powerful and direct relationship with prices among the market actors. It is worth to consider the natural gas plants’ reverse relationship in January-February. More important point to focus is increasing negative effects of wind power plants on prices. The most powerful negative effect was observed in wind power plants in November 2017.

Considering SMF (system marginal price), again, reservoir hydraulic power plants have the most powerful relation, while the wind plants have the most negative powerful relation, this time observed in October 2016. According to this relationship, it could be claimed that wind power plants have started to manage imbalances in a better way.

CONCLUSION:

Theoretically, reservoir hydroelectric power plants has the most positive relationship with price. When prices increase, hydraulic power plants increase production. Whereas with run-off river type plants a negative correlation is observed in rainy days like wind. However, in 2017, a relatively positive correlation was observed. It can be said that the price reducing effects of wind power plants continue to increase gradually, while they manage the unbalancing effects better.

Since lignite power plants are operating as base power, most of the time, it is observed that their effect is less and inversely related with price. It is worth to investigate the natural gas and coal power plants.